Ray Dalio has long been a student of cycles – economic, financial, and societal. His latest book, How Countries Go Broke: The Big Cycle, is a sweeping examination of how nations rise, peak, and decline, often repeating the same mistakes across history. For anyone trying to make sense of today’s turbulent geopolitical and economic environment, Dalio’s work is both a warning and a guide.

Continue readingFinance

From Apps To Avatars: The Four Stages Shaping Banking’s AI Future

For decades, banking has been a place you go, a brand you see, and an interaction you initiate. In this current state, even though much of it is now digital, the model still revolves around channels – apps, websites, and branches – where customers show up to make things happen. AI has entered the picture in narrow, tactical ways: a fraud alert here, a chatbot there, a dashboard with basic insights. Helpful, yes – but far from transformational.

Continue reading2025 Global Risks Report

Every year, the World Economic Forum’s Global Risks Report offers a critical snapshot of the forces shaping our world. The 2025 edition paints a picture of escalating tensions, deepening fractures, and an accelerating transformation of our societal foundations. As we navigate an increasingly complex landscape, the report underscores the necessity of adaptability, resilience, and the capacity to thrive – what I call the ART of navigating uncertainty.

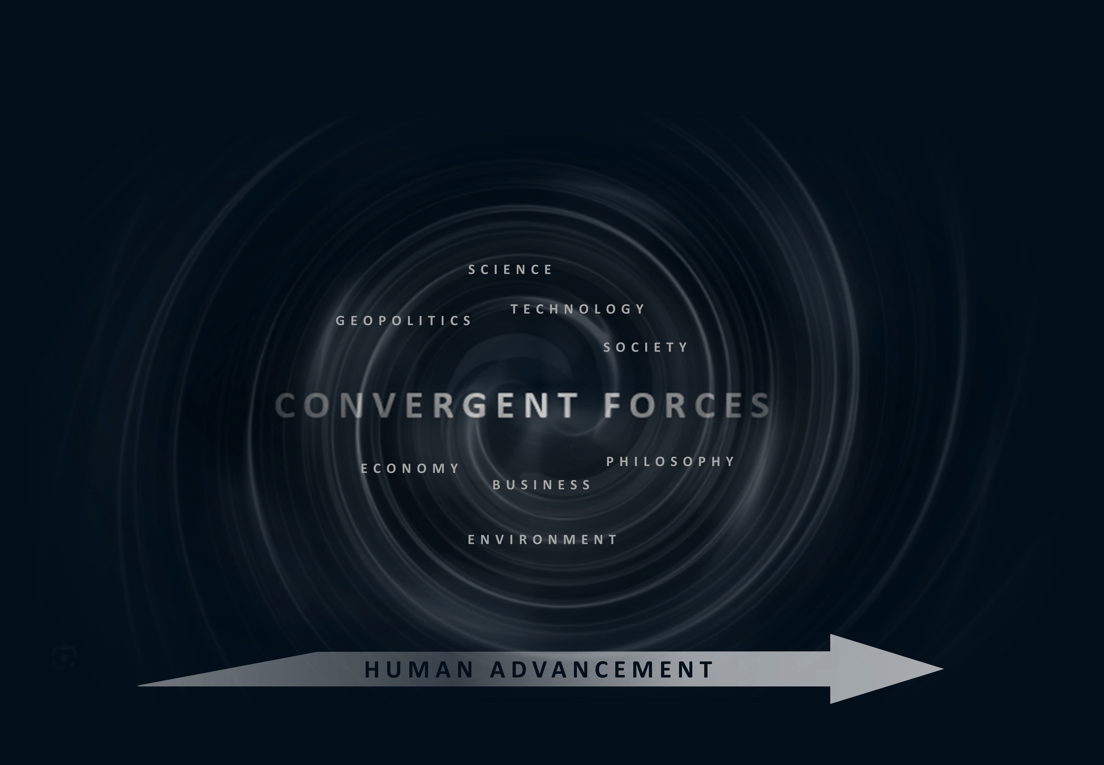

More than ever, this year’s report validates the idea that we are in a period of convergence – where geopolitical instability, technological disruption, societal shifts, economic volatility, environmental stress, and philosophical reorientation are colliding in ways that will redefine our future. Below, I’ve categorized the major risks identified in the report under the seven core convergence domains that I frequently discuss: science, technology, society, geopolitics, economy, environment, and philosophy.

Continue readingA Sweeping Narrative Of Human Progress

In How Economics Explains the World: A Short History of Humanity, Andrew Leigh, a Harvard-trained economist, presents a comprehensive and engaging narrative that delves into the profound impact of economic forces on human history. This book, though concise at under 200 pages, spans a vast timeline from the advent of agriculture to the present day, including the era of artificial intelligence.

Continue readingThe Forces Driving Our Economic Future

At the heart of our uncertain times lies an astounding level of convergence, with historical precedent dating back to the second industrial revolution and the decades that followed. It was Robert J. Gordon in his brilliant journey through the economic history of the western world that illuminated this convergence. In The Rise and Fall of American Growth, Gordon focused on a revolutionary century that impacted the modern standard of living more than any period before or after. It was also Gordon that concluded the world will never see a period like that again. It was his conclusion that prompted my development of a future innovation visual that sought to dispute it. While technology has driven human advancement for centuries, it has not done so in isolation. In periods like the one described by Gordon; other domains play a role in determining where technology takes us. This quote says it best:

Continue readingPossible Futures Emerging Across Multiple Domains

It has been my desire to tell stories; to paint pictures of possible futures. Any story-teller would marvel at the amount of possible futures evolving from the current crisis. I have been a fan of the book the Fourth Turning because of the compelling journey through history that the book takes you on. Stories of crisis that emerged every 80 to 100 years like clockwork; and the reshaping of the social order that followed. It has been a little over 80 years since the last world altering crisis emerged. World War Two qualifies as an event that reshaped the social order when it was done.

The Intersection of Longevity and Finance

I have a fundamental belief that we will not solve the challenges ahead using the institutions and mechanisms of the past. These structures served us during a manufacturing era that looked very different than the world that has emerged in the last three decades. In a recent Article authored by Margaretta Colangelo, she provides an example of this phenomenon. In a time when populations are living much longer than previous generations, leaders are beginning to realize that institutions must be organized in a different way. Ms. Colangelo provides an example in the Finance space, stating that traditional banks weren’t designed to serve a large number of clients living a long time. Today, banks have a small number of clients who are over 100 and they are outliers. In the next decade that demographic will increase dramatically.

Change Has Never Been This Fast – It Will Never Be This Slow Again

Happy New Year all! As we enter the next decade, an expression that is now popular rings true: Change Has Never Been This Fast – It Will Never Be This Slow Again. It is not just the speed of change – which many attribute to Exponential Progression driven in part by the Convergence of Science and Technology –  but the sheer number of Dots Connecting in what is a very complex system. As is customary this time of year, there is no shortage of content focused on the year or decade ahead.

but the sheer number of Dots Connecting in what is a very complex system. As is customary this time of year, there is no shortage of content focused on the year or decade ahead.