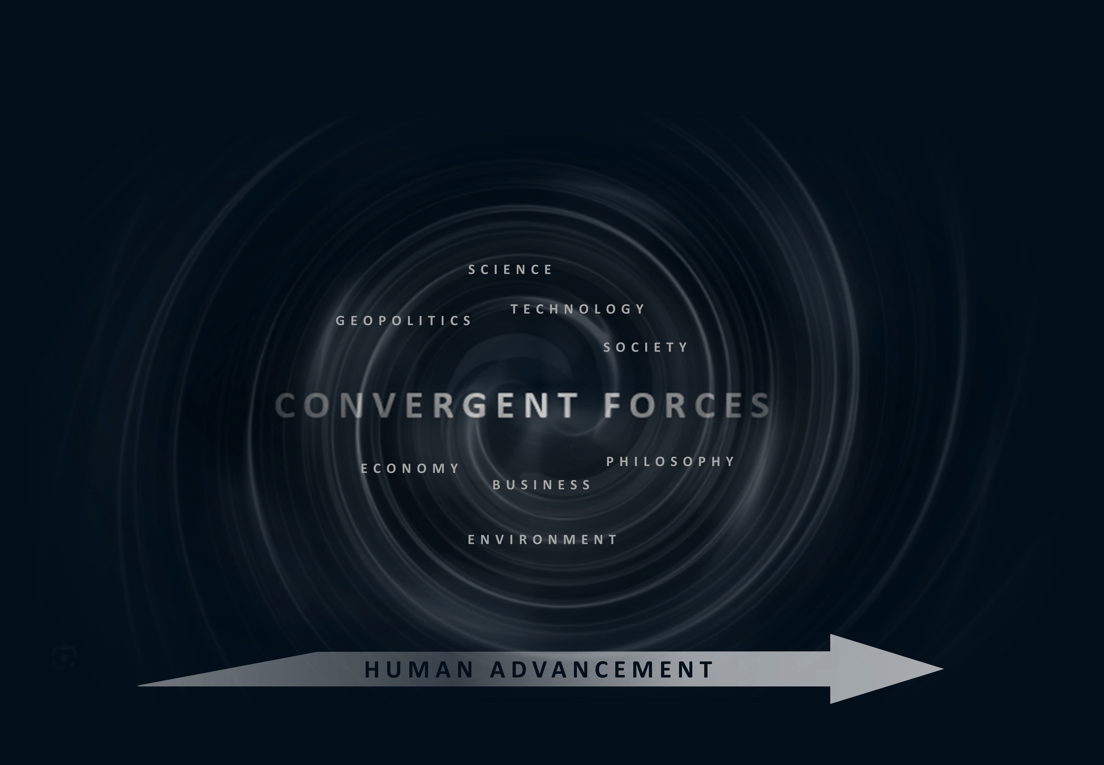

At the heart of our uncertain times lies an astounding level of convergence, with historical precedent dating back to the second industrial revolution and the decades that followed. It was Robert J. Gordon in his brilliant journey through the economic history of the western world that illuminated this convergence. In The Rise and Fall of American Growth, Gordon focused on a revolutionary century that impacted the modern standard of living more than any period before or after. It was also Gordon that concluded the world will never see a period like that again. It was his conclusion that prompted my development of a future innovation visual that sought to dispute it. While technology has driven human advancement for centuries, it has not done so in isolation. In periods like the one described by Gordon; other domains play a role in determining where technology takes us. This quote says it best:

While technological capabilities dictate the potential of any civilization, the organizing system determines how close to this potential a society can get

James Airbib and Tony Seba

An organizing system encompasses both the fundamental beliefs, institutions, and reward systems that enable optimal decisions to be taken across a society and the structures that manage, control, govern, and influence its population. As we consider the impact of convergence, multiple domains are in a state of flux. While science and technology are in the headlines, geopolitics, society, and the economy will have much to say about how close to our potential we can get.

As one of the domains converging, the economy has been a focal point. The economic landscape is evolving rapidly, shaped by an intricate web of forces and risks that span social, economic, technological, and environmental domains. To navigate this complex terrain, central bank leaders must vigilantly monitor, evaluate, and adapt to a multitude of factors that can have profound implications for monetary policy and financial stability. Leaders should focus on several macro-level forces that can impact the economy both now and in the future. Here are some of the most important ones:

Demographic Trends: Population dynamics, including aging populations, low fertility rates, fall in working age populations, and migration patterns, can have profound impacts on labor markets, productivity, and economic growth. Aging populations in the developed world and younger demographics in emerging markets necessitate nuanced policy to balance growth, savings, and healthcare costs. If viewed through the lens of the human life cycle, aspects of the future come into view. A book titled The Great Demographic Reversal recasts the human life cycle from four stages to five. Significant changes are represented by shifts in marriage age, age of first child, retirement age, and the dependent nature of our post-50 lives. The reversal becomes apparent as we witness shifts in what was a positive labor supply shock to a fall in working age population, a baby boom to a dramatic fall in fertility rates, and an earlier retirement period to a later and likely longer retirement.

Climate Change: Environmental risks are increasingly seen as economic risks. Financial institutions are becoming more involved in assessing the financial system’s exposure to climate-related risks and promoting sustainable finance. Environmental shifts pose both immediate and long-term economic challenges. Climate change represents the overarching risk that pervades all economic sectors, with the potential to cause widespread systemic instability. The shift away from fossil fuels toward new energy sources will continue to have wide-ranging economic effects, as the world transitions to a low-carbon economy. Climate change presents systemic risks to the global economy through extreme weather events, transition risks as economies adjust to greener alternatives, and potential physical risks to infrastructure.

Energy Transition: the most difficult transitions throughout human history have been energy transitions. The 1930 date comes up again, as it aligns with the period that began the long transition towards our current fossil fuel era – representing a major transitory period for the world. While Oil & Gas began its meteoric rise in 1859, it was nearly a century later that oil became a major energy source. Past transitions required changes in human behavior, along with massive investments in natural resources, infrastructure, and grid storage. However, the current energy transition is unprecedented in both scale and speed, driving possible economic shifts that are likely to result from changes in energy production and consumption. The shift towards new forms of energy could destabilize traditional energy markets and alter global economic dynamics.

Income Inequality: rising inequality within countries heightens trade conflicts between them. It is another challenge with historical roots. The Gilded Age in American history and the 1920s are two such examples. When a period looks like the past, it is helpful to understand the path of the prior period. Inequality distorts the global economy and opens the door to societal unrest – something that was a direct outcome of those prior periods. High levels of income inequality can lead to social and economic instability. Policies have an impact on income distribution, social contracts, and the broad disparities that can influence policy effectiveness and economic health.

Health Crises: The emergence of health crises, as demonstrated by the COVID-19 pandemic, can have far-reaching economic consequences. As synthetic biology continues its accelerated advance, biowarfare has the potential to cause a dramatic health crisis. Biological incidents anywhere can potentially have profound effects on physical and mental health and well-being, cause significant morbidity and mortality, and disrupt livelihoods and economies, including domestic and international trade and travel. Monetary and fiscal authorities may need to respond with unconventional policies to mitigate the effects on economic activity, labor, and supply chains. This will also place a premium on crisis readiness and an ability to better anticipate extreme events.

Inflation: while many expert opinions are pointing to inflation easing off, few predict that inflation will drop back down to the 2% range that policymakers favor. High, or rapidly rising inflation can erode the purchasing power of a currency, lead to businesses delaying investments, economic instability, and drive uncertainty for businesses and consumers. Inflation is the rate at which the general level of prices for goods and services is rising, and it can have a significant impact on the economy. While high inflation can lead to a decrease in purchasing power, low inflation can lead to deflation, which can be equally problematic. Monetary policy is used to control inflation by adjusting interest rates and the money supply.

Geopolitical risks: Geopolitical risks are the risks associated with political events and developments around the world, such as wars, conflicts, and natural disasters. We live in an era of increased geopolitical tensions – a period that eerily resembles the 1920s and 1930s. As nations seek to shift from a unipolar to a multipolar world, and the current world order is challenged, geopolitical tensions are sure to rise. History is filled with examples of emerging powers challenging existing powers. Political instability, trade disputes, and geopolitical conflicts can have a significant impact on economies by affecting trade, investment, and consumer confidence.

Technological advancements: Technological advancements can have a significant impact on global economies by changing the way people work, consume, and invest. It was the great inventions of the second industrial revolution that set the foundation for human development and drove a period of accelerating productivity gains. As we find ourselves approaching another period of great invention, foundational shifts in our societal platform (i.e., energy, transport, communications) should be expected. We may see another period of accelerated productivity gains, with the potential impact on global economies and individuals. Automation driven by changing demographics and major scientific advancements make this a key macro-level force.

Rapid technological advancements, such as digital currencies, AI, blockchain, and fintech, are transforming the financial landscape and reshaping the financial sector – requiring proactive regulatory adaptation. Other influences on global economies include data privacy and ownership, synthetic biology, virtual economies, and Post-Quantum Cryptography.

Cyber Risk: technological advancements represent a dual-edged sword presenting opportunities for human advancement but also substantial cyber risks. Risks of cyberattacks on financial infrastructure and data integrity drive the need to ensure the national financial infrastructure is resilient to cyber-attacks and system failures. A cyberattack on a central bank could have serious consequences, including the loss of sensitive financial data, disruption of financial markets, and even the theft of funds.

Unemployment: unemployment is the number of people who are actively seeking employment but are unable to find work. High unemployment can lead to a decrease in consumer spending, while low unemployment can lead to an increase. Employment is a key indicator of the health of the economy. Monetary authorities typically aim to promote full employment, as this can lead to higher economic growth and lower poverty rates. However, low unemployment can lead to inflation. Automation and the gig economy are restructuring traditional employment, demanding policy flexibility to support transitions. The conflicting narratives of technology-fueled job loss, and the automation required to address the fall in working age population, will play out in this decade.

Deglobalization: Current trends suggest a potential deceleration in globalization and shifts in global trade and investment patterns due to changing political and economic landscapes. That could induce protectionist measures, disrupting trade and capital flows. Conflicts, trade wars, and shifting alliances influence global economic stability. The evolution of trade and shifts in global trade dynamics include potential reshoring or regional trade blocs.

Reskilling Society: in times of transition, education has always provided a bridge. The global community must prioritize education and skill development to prepare workforces for future economic demands. Failure to adapt education systems to future needs could result in a mismatch between skills and labor market demands.

While these macro-level forces represent some unique challenges, the fundamentals of monetary and fiscal policy remain the same:

Interest rates: Interest rates are the cost of borrowing money, and they can have a significant impact on the economy. Higher interest rates can lead to a decrease in borrowing and spending, while lower interest rates can lead to an increase. Central banks often use monetary policy to adjust interest rates to influence borrowing and spending by individuals and businesses. They use interest rates as a tool to control inflation and stimulate or cool economic activity. There is difficulty in managing the benchmark interest rate to stabilize growth and inflation. Inappropriate interest rate levels can lead to economic overheating or unnecessary cooling and remains a fundamental challenge.

Exchange rates: Exchange rates are the value of one currency in relation to another, and they can have a significant impact on international trade and investment. Monetary policy is often used to influence exchange rates by buying or selling currencies on the foreign exchange market. The value of the national currency in foreign exchange markets affects international trade and capital flows. Central banks may intervene in these markets to influence exchange rates, while attempting to balance domestic economic concerns with international impacts.

International trade: International trade is the exchange of goods and services between countries. Monetary authorities typically aim to promote free and open trade, as this can lead to higher economic growth and lower prices for consumers. However, trade disputes and other protectionist measures can harm the economy, and create risk associated with sudden stops or reversals in international capital flows.

Economic growth: Economic growth is the rate at which the economy is expanding – the increase in the production of goods and services over time. High economic growth can lead to an increase in consumer spending and investment, while low economic growth can lead to a decrease, job losses and lower incomes. Monetary policy is often used to influence economic growth by adjusting interest rates and the money supply. Promoting sustainable economic growth is another core mission, as this can lead to higher living standards for everyone. However, rapid economic growth can lead to inflation and other problems. Central banks monitor GDP growth, employment levels, and productivity to ensure the economy is operating at or near its potential.

Financial Stability: the stability of the financial system must be safeguarded, made to withstand shocks and continue operating smoothly. This involves monitoring the health of banks and financial institutions, assessing systemic risks, and implementing regulations to prevent financial crises. Financial system vulnerabilities can build up over time, and central banks need to be vigilant in monitoring and addressing these risks. A financial crisis can lead to a sharp decline in economic activity and asset prices. This can lead to widespread job losses and recession. Central banks use a variety of tools to manage macro-level forces and promote economic stability. These tools include interest rates, reserve requirements, and open market operations. Central banks must carefully calibrate their use of these tools to avoid unintended consequences. They must be wary of asset bubbles, market corrections, and the systemic repercussions thereof. They must also monitor asset price fluctuations and their potential systemic impacts, while ensuring the solvency and reliability of financial institutions.

Monetary Policy: Developing and implementing effective monetary policy is a crucial task. Central banks use tools like open market operations, reserve requirements, and interest rates to manage the money supply and achieve their policy objectives. Monetary policy expectations are the expectations of businesses and consumers about how the central bank will set interest rates in the future. Central banks need to communicate their policy intentions clearly to avoid surprises and market disruptions. Leaders must embrace policy innovation and flexibility by developing adaptive policy tools and frameworks that can respond to the rapid pace of change. An additional challenge lies in unwinding unconventional monetary policies.

Fiscal Policy: Coordinating with fiscal authorities (the government) is essential to ensure that monetary and fiscal policies are aligned to support economic stability and growth. Government fiscal policy refers to the government’s spending and tax policies. Central banks need to coordinate with governments to ensure that fiscal and monetary policies are aligned.