This Analysis by the Conference Board underscores how the trajectory of COVID-19 and the economic response over the next few months are uncertain. They developed three scenarios for the course of the US economy for the remainder of 2020. Focusing on future scenarios was already a critical imperative given the pace of change; the current pandemic just underscores the point. The analysis authors from the Conference Board are: Bart van Ark, Executive Vice President & Chief Economist, and Erik Lundh, Senior Economist. Here is an executive summary from the report:

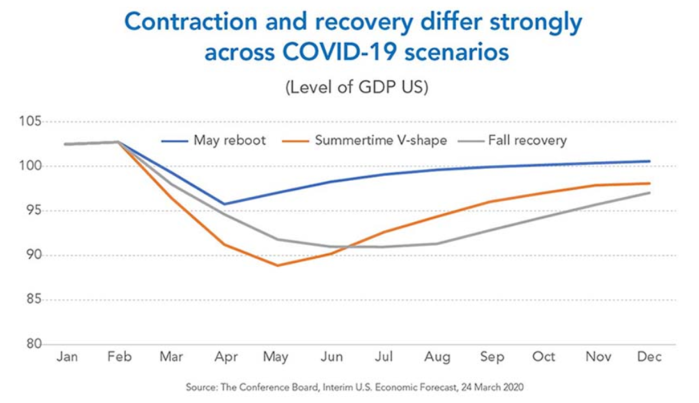

- May reboot (quick recovery): Assuming a peak in new COVID-19 cases for the US as a whole by mid-April (with some possible variation by region), economic activity may gradually resume beginning in May. GDP growth will shrink by 1.6 percent in 2020 (over 2019).

- Summertime V-shape (deeper contraction, bigger recovery): The peak in new COVID-19 cases will be higher and delayed until May, creating a larger economic contraction in Q2 but a stronger recovery in Q3 than in the scenario above. The GDP contraction will be much stronger at 5.5 percent.

- Fall recovery (extended contraction): Managed control of the outbreak helps to flatten the curve of new COVID-19 cases and stretches the economic impact across Q2 and Q3, with growth resuming by September. The GDP contraction will be much stronger at 6.0 percent.

MAY REBOOT SCENARIO – QUICK RECOVERY

This scenario assumes that the number of new COVID-19 cases added daily will stop accelerating by mid-April. While the number of sick people may continue to increase into May or June, it might then be possible to allow a controlled reboot of the economy by the month of May. Biggest industries impacted: Arts, Entertainment, Recreation, and Accommodations, Transportation & Warehousing, Retail Trade, Manufacturing, Finance and Insurance. Unemployment will rise to 8 percent by the third quarter, but gradually level off after that. The economy will contract by 16.5 percent in the second quarter which equals a decline in the level of GDP of about 4.5 percent compared to the first quarter. The annual loss in GDP in 2020 will end at 1.6 percent compared to 2019.

SUMMERTIME V-SHAPE – DEEPER CONTRACTION, BIGGER RECOVERY

This scenario assumes that the peak of new COVID-19 cases will be higher and take more time to go down to acceptable levels than the May reboot scenario does. No restart of the economy would be likely before June or even July. In this scenario, as new cases continue to escalate beyond mid-April, social distancing and other containment measures are likely to remain in place for longer. Here, Retail Trade, Wholesale Trade, and Manufacturing get hit harder. Per the analysis, the economy will contract deeply by 35.6 percent, annualized, during the second quarter, which equals a drop in GDP of more than 10 percent, and by year-end, the economy will finish below where it started, and GDP growth will show a decline of 5.5 in 2020 compared to 2019. Unemployment will go up much faster in this scenario and could hit 15 percent by Q3, after which it may level off to 10 percent toward the end of the year.

FALL RECOVERY SCENARIO – EXTENDED CONTRACTION

Per the analysis, the final scenario assumes a more effective and managed control of new COVID-19 cases. This reflects the current balancing act confronting all leaders: while extending social distancing and other containment measures likely reduces the pressure on the health care system and the potential number of fatalities in the coming months, it also means that the reboot of the economy will not begin until September. In addition to the previously mentioned sectors, weakness will extend to Finance & Insurance, Professional & Business Services, and others. The authors expect budget cuts and cost cutting, which forces more companies to reduce their workforce, raising unemployment to 15 percent—a level which might extend all the way to the end of the year. The economy in 2020 will contract by 6 percent (over 2019). The authors state that this would be the largest decline since 1946 when the economy dropped by almost 12 percent as a result of WWII demobilization and the sharp pullback in military production. They provide this comparison: in 2009, the economy contracted by just over 3 percent compared to 2008.

The analysis concludes that economic activity will drop between 1.6 and 6 percent regardless of the scenario. Critical insight from the analysis points to a drop in consumer spending in places like the service sector that cannot be made up through pent-up demand later in the year. This will temper the rebound. In other sectors, such as Manufacturing and Transportation & Warehousing, pent-up demand is more likely, and the gap in economic activity levels may narrow strongly by the end of the year.

The report notes that the latter two scenarios are more likely. For a look into the full analysis by the Conference Board go Here.

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Impact on Supply Chains Post COVID-19 Economic Recovery Scenarios Is The Canary Dead? A Post Pandemic Society How Will The Corona Virus Impact Globalization? The […]

LikeLike

[…] Impact on Supply Chains Post COVID-19 Economic Recovery Scenarios Is The Canary Dead? A Post Pandemic Society How Will The Corona Virus Impact Globalization? The […]

LikeLike

[…] Impact on Supply Chains Post COVID-19 Economic Recovery Scenarios Is The Canary Dead? A Post Pandemic Society How Will The Corona Virus Impact Globalization? The […]

LikeLike

[…] Impact on Supply Chains Post COVID-19 Economic Recovery Scenarios Is The Canary Dead? A Post Pandemic Society How Will The Corona Virus Impact Globalization? The […]

LikeLike

[…] Impact on Supply Chains Post COVID-19 Economic Recovery Scenarios Is The Canary Dead? A Post Pandemic Society How Will The Corona Virus Impact Globalization? The […]

LikeLike

[…] Impact on Supply Chains Post COVID-19 Economic Recovery Scenarios Is The Canary Dead? A Post Pandemic Society How Will The Corona Virus Impact Globalization? The […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike

[…] Post COVID-19 Economic Recovery Scenarios […]

LikeLike