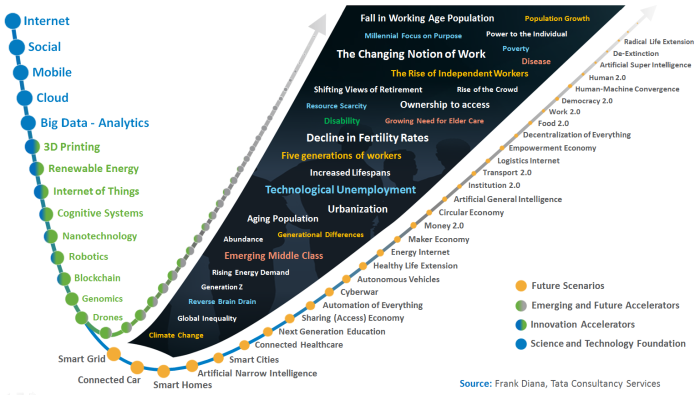

Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green, Circular, Mesh, Digital, Innovation, semantic, and more. This combining of words speaks to the truly disruptive nature of the early 21st century. As part of my focus on business evolution and the inevitable move towards digital enterprises, I have analyzed a number of disruptive scenarios and their implications to traditional companies. This visual describes a combinatorial innovation dynamic that spawns disruptive scenarios:

There could indeed be a new economic paradigm spawned from the combination of disruptive scenarios – and one of the key drivers is the sharing or collaborative economy. This specific combination of words originated in the mid-2000s, and is defined by Wikipedia as a socio-economic system built around the sharing of human and physical resources. Jeremiah Owyang – Founder of Crowd Companies – sees The Collaborative Economy as the next phase of social business. Some attribute this movement to the Global Recession of 2008, where the economic downturn drove people to these collaborative methods to make ends meet.

In this piece on Workers in the Sharing Economy, the author argues that the rise of labor marketplaces is attributed to the lack of stable employment driving people to pursue ad hoc tasks. Although there are no definitive statistics on how many people work in what some call the gig economy, a report from MBO Partners indicates that about 17.7 million Americans last year worked more than half of their time as independents. The CEO of TaskRabbit – a task and errand labor marketplace – said that 75% of workers using their platform depend on task postings to stay afloat. But working in the sharing economy may not just be a means of staying afloat. Uber announced that the median annual income for a driver in New York City is $90,766, a salary over triple the estimated median income for a typical U.S. cab driver. Uber also reported a median income of $74,191 in San Francisco. So Uber gives drivers a lift, and their rapid expansion could be good for the economy as well. An ECOnorthwest study commissioned by Uber claims the company creates 20,000 jobs every month and has a $2.4 billion annual impact on the U.S. economy.

Marketplaces for labor are expanding beyond tasks and errands to include all types of freelance talent, making the sharing economy even hotter. However, like any disruptive scenario, there are detractors. Some believe that the sharing economy will have catastrophic ripple effects on home prices, demand for new houses and cars, and the structures of production, sales, and employment. Others suggest that this new business model is largely based on evading regulations and breaking the law. A reasonable argument can be made that incumbents are disadvantaged. Cities and states both tax and regulate hotels, and guests are an important source of tax revenue. In many cases customers of these sharing economy companies are not paying taxes.

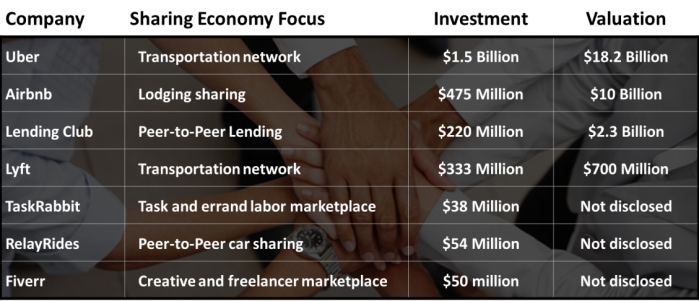

However, the evidence suggests that this train is not slowing. The sharing economy generated $3.5 Billion in 2013, with 17.5 million active American users of sharing economy companies like Uber, Airbnb, and TaskRabbit. Additional evidence shows an accelerating phenomenon with an overall Market Size of $110 billion in 2013, and the leaders in this space are doing very well. Analysts estimate $213 million in Uber revenue last year, and Airbnb now tops the $9.5 billion valuation of the Hyatt Hotels and the $9.3 billion valuation of the Wyndham Hotel Group. Further evidence of traction can be found in an investment community that loves sharing economy companies and their small asset and employee base. A recent piece describes why many are investing in these companies and the visual below shows the magnitude of both investment and valuation.

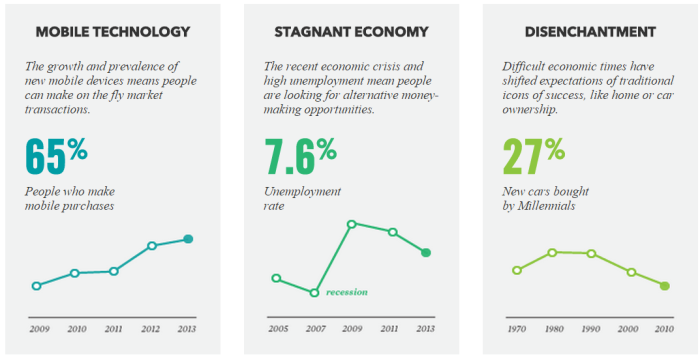

Why Now? No matter what disruptive scenario we focus on, the question of why now is front and center. In the case of the sharing economy, this Infographic identifies three different drivers:

Source: gravitytank

I’d argue that a societal shift is the major factor, driven largely by the sharing mentality of Millennials. This shift from an ownership economy to a sharing or access economy supports the growing notion that A New Economic Paradigm is on the horizon, and counters the argument that this fad will pass with an improving economy. There is clear evidence to support this societal shift to access versus ownership. For example, streaming in media killed any notion that music or film consumption was the exclusive realm of ownership and rental models. In fact, these societal shifts – supported and enabled by the exponential growth of technology and innovation – are happening at an accelerated pace. Some of these shifts are described effectively in this piece on the move to Platforms. Through the examples provided, we can see how the notion of sharing and ecosystems is driving us towards a disruptive future where companies provide the platform for value creation – versus creating the value themselves.

Obstacles Every scenario has a set of obstacles that can alter its ultimate path. In the case of the sharing economy, perhaps the biggest challenge is regulation. Regulatory structures are geared toward businesses – not prosumers that leverage their assets or talents to provide services. New regulatory action could either slow or block these new services by making transactions illegal or costly. Incumbents continue to pursue protectionist strategies to protect their revenue base – see Uber vs. the law. Other unforeseen obstacles could be a loss of trust driven by events that raise safety concerns, unanticipated technological disruption that renders sharing economy models obsolete, loss of differentiation as platform models proliferate, or loss of investment that limits growth potential.

Assessing the Disruptive Scenario The term disruption will soon take a similar path as the eBusiness label. As the pace of disruption accelerates, it becomes a standard way of operating, and those companies that are fast, adaptive, responsive, flexible, and nimble will survive, continually disrupting themselves and the market. Nonetheless, the implications of disruption today are very real, and the sharing economy could have a significant impact on current revenue streams and business models. For example, Altimeter Partners reports that every car-sharing vehicle drives a revenue loss of at least $270,000 to an average auto manufacturer by reducing car ownership by 9-13 vehicles. The impact however is greater, as a cascading effect impacts auto loans, car insurance, fuel, auto parts, and other services.

As it is with every scenario, leaders need to see its disruptive potential and develop strategies to respond. This PWC Presentation explores the issue of sharing economy disruption in detail, and assesses the scale of the potential revenue at stake. They did this by looking at ten sectors split between a sharing economy group (P2P finance, online staffing, P2P accommodation, car sharing, and music and video streaming) and a traditional group (equipment rental, B&B and hotels, car, book, and DVD rental). Through their analysis, they estimate that the sharing economy group contributes just $15 billion – or 5% of total revenue today – but have potential revenues of $335 billion by 2025 – putting over 50% of revenue at stake.

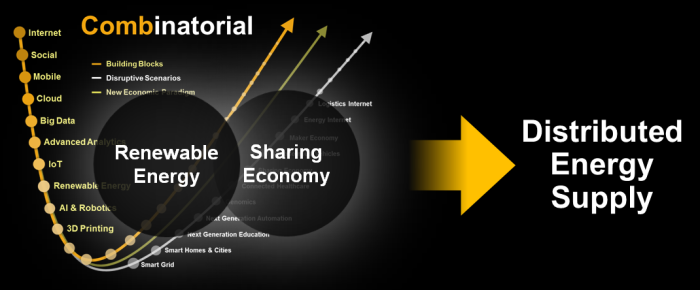

The implications of a sharing economy are not limited to these sectors. In a recent post on Combinations and Disruption, I described the multiplicative effect of combinatorial innovation. The sharing economy is likely to combine with other disruptive scenarios and building blocks to amplify and accelerate the impact of disruption. For example, as the renewable energy footprint expands, energy prosumers could start to share excess electricity with their neighbors through a distributed energy supply. Building on the combinatorial innovation visual above, the renewable energy building block combines with the sharing economy disruptive scenario to create this distributed energy supply. Jeremy Rifkin describes this as an Energy Internet.

In addition, technology has enabled the forming of peer-to-peer networks that can render traditional business models obsolete. As this phenomenon expands, the likely role of traditional business is enabling platform. Two drivers factor into this platform movement. 1) Value creation increasingly shifts from the firm-level to an ecosystem-level. 2) Consumers increasingly become producers or prosumers. In both scenarios, the platform is the enabler. This is playing out in sector after sector. We’ve already talked about the impact to transportation and hospitality. What other examples are emerging across industries?

Communications: How about sharing a Wi-Fi connection? Fon – a Crowdsourced Wi-Fi internet service provider – allows WiFi customers to share their connection with others in return for free access to other Fon hotspots around the world. Fon residential members install a router that then becomes a node in a hotspot network spanning 13 million nodes worldwide. So in effect, the customer is sharing some of its network service and in return receives what would otherwise be a paid-for service free of charge.

Retail: as sharing models like Peerby proliferate, expect Retailers to assess the potential of sharing models for their business. Peerby is a Dutch startup that operates a peer-to-peer sharing service for products. Users share or request items from people in their neighborhood online. These Sharing services disrupt markets in new and unforeseen ways. An example of new value propositions can be found in a two year old company called Instacart. The founder, Apporva Mehta (a former Amazon employee) recently announced a $44 million round of VC financing. The value proposition is simple: hired shoppers buy and deliver the products that customers order from a variety of supermarkets. The companies, and shoppers, make money from delivery fees. As it is with sharing economy companies, the primary investor attraction to this grocery disruptor is that investment in maintaining or updating capital-intensive infrastructure is unnecessary. Instacart does not own warehouses or delivery trucks.

Healthcare: The Sharing Economy is Invading the Health-Care Industry, as technology helps connect people with chronic illnesses. These connections enable the sharing of stories, disease research, coping strategies, treatment and diagnosis tips and advice, and saving money. Sharing is one of multiple disruptive scenarios impacting Healthcare.

Insurance: Many factors are converging to create The New Face of Personal Auto. Uber, for example, has created coverage gaps. Initially, personal insurance was intended to pick up coverage, but it is not really designed for that. Since this is more of a commercial exposure, many states are passing laws requiring transportation network companies like Uber to provide primary coverage of at least $1 million. This is another industry under attack from multiple disruptive scenarios.

Media & Information Services: does the sharing economy Disrupt Digital? Established brands are not the only means of distribution and funding for content creators. In a sharing economy context, the institution is increasingly acting as an enabler versus content creator. So, digital brands will increasingly change their business models to facilitate information flows.

Energy: this industry is already seeing an increasing level of disruption, especially in places like Germany where renewable energy is a growing piece of the energy mix. Add the sharing economy to the mix, and we may be approaching An Airbnb or Uber for the Electricity Grid. Centralized infrastructure has dominated the energy arena for over a century, but distributed energy resources are changing the economic landscape. We could be in the early stages of a sharing economy revolution for the grid. The article referenced above speaks to the sharing mechanisms leading to increased asset utilization rates and improved system economics. The platform has been the missing piece. Netherlands-based Vandebron launched one such platform, which allows individuals to buy electricity straight from a prosumer with excess electricity production.

Formulating a Response As with every disruptive scenario, traditional companies should first understand the implications of each scenario, and then develop a response. Experimentation and a lean start-up approach in these early stages are critical. A starting place that is applicable across every industry is to assess the potential for sharing the existing asset base. Underutilized assets represent a new revenue stream, and sharing economy mechanisms provide the platform for monetization. More importantly however is the disruptive nature of new business models enabled by these platforms. As new value propositions emerge, traditional models become obsolete. The ultimate response may be the shift From Pipes to Platforms as mentioned earlier. This shift however is challenging, as traditional companies think at the firm-level, but must pivot to Ecosystem Thinking. The same ownership to access dynamic playing out at the societal level will play out as part of the enterprise response. This quote from the above platform article captures it well:

“Increasingly, resources are not the definition of scale anymore. Airbnb and Uber aren’t multi-billion dollar businesses for the employees and resources they control in-house but for the ecosystem they succeed in attracting. Ecosystems are the new scale and the new source of competitive advantage.”

Lastly, a shift in the way companies think is required to successfully respond to this sharing economy scenario. That shift – from transactions to interactions – determines success in the future, and drives a critical need for both collaboration and analytic excellence. Again, the article says it well:

“While hotels and traditional cab companies owning their own fleet would get a team of MBAs working on maximizing capacity utilization, Airbnb and Uber focus on getting data scientists to improve algorithmic matching of supply and demand. Nowhere is the shift from process to interactions better exemplified than in the shift from process re-engineering to data science as the highest paid skill in companies.”

In summary, ecosystem and platform thinking are the foundational elements of the traditional company response to the sharing economy disruptive scenario.

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,… […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,… […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green, Circular, Mesh, Digital, Innovation, and more. This combining of words speaks to the truly disruptive nature of the early 21st century. As part of my focus on business evolution and the inevitable move towards digital enterprises, I have analyzed a number of disruptive scenarios and their implications to traditional companies. This visual describes a combinatorial innovation dynamic that spawns disruptive scenarios: […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green, Circular, Mesh, Digital, Innovation, and more. This combining of words speaks to the truly disruptive nature of the early 21st century. As part of my focus on business evolution and the inevitable move towards digital enterprises, I have analyzed a number of disruptive scenarios and their implications to traditional companies. This visual describes a combinatorial innovation dynamic that spawns disruptive scenarios: […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,… […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,… […]

LikeLike

Reblogged this on vienergie.

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,… […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,… […]

LikeLike

[…] “Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green,…” […]

LikeLike

[…] economic paradigm shifts. Three of our disruptive scenarios above fall into this category: the sharing, maker, and circular economy. I will do a separate piece on the circular economy, but a good primer […]

LikeLike

[…] See on frankdiana.wordpress.com […]

LikeLike

[…] See on frankdiana.wordpress.com […]

LikeLike

[…] Something Economy: seems like a popular trend – stick a word in front of economy and use it to describe the next big thing. Some of these words are: Peer, Maker, Sharing, Gig, Collaborative, Green, Circular, Mesh, Digital, Innovation, semantic, and more. This combining of words speaks to the truly disruptive nature of the early… […]

LikeLike

[…] would indicate traction. As several scenarios like the connected car, the driverless car, and the sharing economy converge, this ecosystem begins to form. Various relationship strategies are emerging from major […]

LikeLike

[…] 2014, I had this to say about the trend of putting a word in front of the word economy and declaring a new era: Something […]

LikeLike