This post continues the disruption scenario discussion initiated by my earlier Insurance Industry Case Study. I’ve been using the autonomous vehicle (AV) as an example of a disruptive scenario with potential societal, economical, and environmental impact. In this post, the focus shifts to the scenario’s possible effect on the automotive ecosystem.

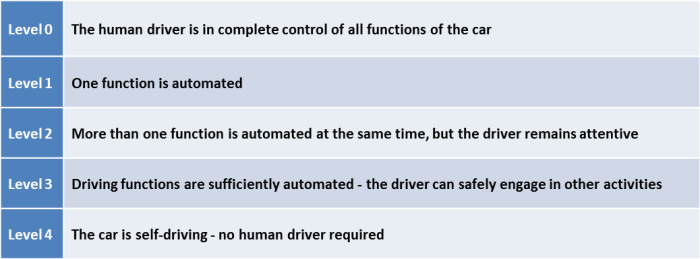

Autonomous vehicle technology can be viewed using a five-part continuum suggested by the National Highway Traffic Safety Administration (NHTSA), with different benefits realized at different levels of automation:

Last month, an IHS Automotive study predicted the world will have nearly 54 million self-driving cars by 2035. The study also predicts that nearly all vehicles in use are likely to be self-driving cars or self-driving commercial vehicles sometime after 2050. Meanwhile, automakers and others are unveiling both their plans for – and introduction of – automated features:

- In December 2013, Ford unveiled a self-driving research car – a modified Fusion Hybrid

- Volvo announced the 2017 intro of 100 AVs in Gothenburg Sweden

- Google has a fleet of fully autonomous Priuses and will release its technology in 2018

- Nissan announced in August the first “commercially viable” self-driving system by 2020

- GM, Audi, BMW, Tesla and others, also have AVs in development

- The 2014 Mercedes-Benz S-Class will be the first car on the market fully capable of driving itself

In my previous post, I discussed the societal benefits of an autonomous vehicle over time. In a current Forbes series, Chunka Mui describes why the Driverless Car Is Worth Trillions, and offers the following additional insight: The World Health Organization estimates that more than 1.2 million people in the world are killed on roads each year, and as many as 50 million others are injured. The WHO also predicts a worsening of road traffic injuries, and sees it becoming the fifth leading cause of worldwide death by 2030. This will account for 3.6% of the total – versus 2.2% in 2004 when it was the ninth leading cause. Given that a large percentage of accidents are due to human error or alcohol use, driverless cars have an opportunity to dramatically reduce the frequency of crashes and save many lives. I recommend this Forbes series for a closer look at the autonomous vehicle phenomenon.

Several other driverless car benefits may materialize, as described by various sources including Mr. Mui. For example, AVs might save developing countries from replicating car-centric infrastructures similar to those in most western countries – comparable to the leapfrogging that happened with telephone systems. This partial list of additional benefits was gathered from a recent Rand Corporation report, as well as the Forbes series referenced earlier:

- No need for police officers to write tickets

- Reduction in the need for traffic or street lights

- Less spend on prisons

- Less expensive, narrower roads

- Potential reduction in congestion and related costs

- Improving fuel economy

- Enabling alternative fuels

- Increase mobility for those unable or unwilling to drive

- Reduction in drivers marginal travel costs

- More land and building space dedicated to human occupancy

- Less pollution: alternative fuels, reduction in vehicle miles traveled

- Positive effect on environmental outcomes

- Higher vehicle throughput on existing roads

- Productivity gains: focus on other activities while driving

But is the hype warranted? Can the challenges and obstacles be overcome? The Rand Corporation provides a perspective. They recently published an in-depth look into this potentially disruptive scenario titled Autonomous Vehicle Technology – a Guide for Policy Makers. Combined with observations by Chunka Mui, they provide a great view into the possible barriers to autonomous vehicle adoption:

- Driving enjoyment keeps adoption rates low

- Adoption rates low as benefits accrue to parties other than owner

- The cost of autonomous vehicle technology

- Prohibitively expensive public infrastructure

- Uncertain business model

- Potential $2 trillion disruption de-motivates ecosystem participants

- Significant job loss

- Loss in organ and tissue donations

- Liability implications

- Conflicting laws and regulations hamper manufacturing & deployment

- Different state testing and certification processes

- Distracted driving legislation

- Complex and unclear legal implications

- Regulating many diverse vehicles with different operating constraints

- Licensed spectrum and related policy issues

- Costs exacerbate crash risk disparities between rich and poor

- Worsening of energy use and environmental outcomes

- Challenges with an AVs perception of the environment

- The human-machine interface

- Overcoming reliability and safety challenges

- Enabling consistent operation anywhere

- Ensuring security and integrity

- Data ownership and privacy

- Senior drivers interacting with complicated technology

- More vehicle miles traveled increases pollution, congestion, and fuel consumption

With an assumption that autonomous vehicles will be reality somewhere on the five-part continuum, some level of disruption should be expected. To provide some perspective, this one scenario has the potential to impact the following members of the automotive ecosystem: Automakers, parts suppliers, car dealers, auto insurers, auto financiers, body shops, emergency rooms, health insurers, medical practices, personal-injury lawyers, government taxing authorities, road-construction companies, parking-lot operators, oil companies, urban real estate owners, electronics companies, and others. Using the same sources as above, we get a look into several disruption examples:

- Less car sales impact a $600 billion annual U.S business

- Drop in sales affect auto finance companies

- Ride sharing trends may break current business models

- Drivers subscribe to transportation service versus owning cars

- One car owned, others move from ownership to transportation service

- Barriers to entry fall as smaller cars are easier and cheaper to build

- Shared cars are sold as fleets, rather than through dealership networks

- Product cycles accelerate – driven by more frequent car replacement

- Car-related cases disappear for personal-injury lawyers

- Undermining parking operator and municipal revenue streams

- Undermining public transit systems and municipal finances

- Governments losing fines because cars obey traffic laws

- Utilities impacted by reductions in the need for traffic and street lights

- Construction companies impacted by reductions in road work

- Producers of cement and asphalt will likewise be impacted

- Gasoline sales drop as cars operate more efficiently

- Many parts would disappear from cars affecting many parts suppliers

- Drop in steel usage negatively affects the steel industry

- Body shops would mostly disappear for lack of business

- Multi-year contracts for connectivity or software break business models as cars are given away

- Rush hour-drive time radio will adapt or die

- If getting to and from places is more seamless and enjoyable mass transit will be threatened

- Mid range and long range transportation and delivery services disrupted

- Short distance airlines suffer as commuters chose driverless cars

- Hotels and motels affected as people sleep in the comfort of self-driven vehicles

As described in my recent post titled Why Focus on Disruption, no one has a crystal ball. Whether these possibilities come to fruition remains to be seen. But I’d say it is safe to bet that something will happen in the next decade; even if we only make it to level 2 on the five-part continuum. Even small gains across multiple scenarios drive disruptive impact. As such, the ability to continually Sense and Respond to stimuli in the environment is critical to both short term success and long term strategy. Strategy is now an iterative process driven by ongoing scenario analysis – constantly informed by real time insight. Insight is not the byproduct of traditional rearview mirror reporting, but the result of on-going forward looking analysis that leverages the growing volume of data for its insight. The successful company is an emergent company that continually looks across a growing ecosystem to enable this scenario analysis. It will embrace an experimental mindset that allows them to rapidly advance ideas to inform their strategy. Through this process, possible responses to disruptive threats can be formulated. In the previous research on autonomous vehicles, our authors provide some examples of automotive ecosystem response to the impact of this technology. Here are some possible responses, as driverless vehicles allow for the re-conceptualization of cars and car-related business models:

- Automakers as fleet operators and transportation service providers

- New business models emerge providing cars for free in return for a multi-year contract in other areas – similar to what mobile phone operators do when they subsidize the purchase of phones

- Automakers bundle Insurance via their warranty operations

- Automakers provide free, high speed Internet access as cars cooperate with other cars to form a mesh network

- Dealers become Apple-like stores where car Apps are purchased

- Cars become platforms where third parties create apps that are sold through App stores

- Automakers move downstream to engage more directly with consumers

- Automakers become brokers that help car owners rent their unused cars (GM-RelayRides partnership)

- A market leader emerges with an operating system for the car platform that captures a huge share of value

- Automakers open cars up for developers to write apps that make the use of a car more productive or enjoyable

- Automakers deliver a concierge service: Car maintenance, providing remote changes to engine settings, collect and interpret performance information, other car-related activities

- New industries like auto-décor will emerge

- Food services, food brands, and kitchen appliances will be designed for in-car use

- New car-based business models in the sex, drugs, and alcohol industries

- Reductions in organ donations due to fewer accidents will fuel advances in 3D Printed biomaterial research

- The obsolescence of the driver’s license will jump-start the widespread use of other forms of ID, such as biometrics and chip implants

- Towns that rely on parking ticket and speeding revenues will experience budget shortfalls. They will be forced to seek new forms of revenue, serving as a catalyst for innovation

- New retail destinations will pop up in unusual places

- Retail on wheels will explode

Other observations from work done by Chunka Mui:

- Although we tend to think of customer experience in a traditional marketing and channel sense, next generation experiences extend to the car, smart home, and countless others. Creating the next generation car experience offers opportunity for Electronics companies, Media & Information Services, and others. This expands the automotive ecosystem opportunity and supports a growing movement towards Value Ecosystems

- In creating this next generation experience, Mr. Mui expects vehicle design to shift away from safety considerations and towards style. As driverless cars dramatically reduce human error and the concept of shared cars gains broad acceptance, possible car designs will explode. With driver distraction issues going away, media companies, electronics companies and app makers could outfit cars with infotainment that exploits now-free time in self-driving cars

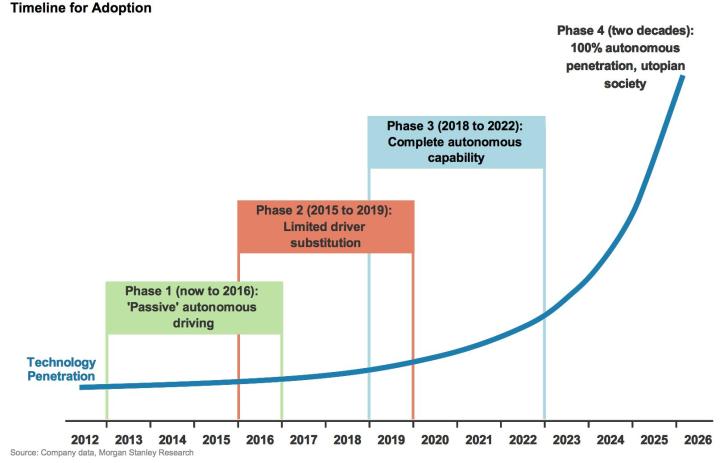

One final addition to this original post now includes an adoption timeline pulled together by Morgan Stanley:

Jeremiah Owyang provides additional insight through his recent Post on the topic, and its connection to the Sharing economy disruptive scenario. That wraps up this look at possible disruption in the automotive ecosystem. My next post will focus on the potential disruptive scenarios in the Healthcare industry. Although illustrative, the compelling reason for action is not tied to any specific scenario, but the fact that the number of scenarios – driven by several forces – is likely to multiply. As this happens, the probability of disruption grows rapidly, creating a societal impact not seen since the First Industrial Revolution. It is the accelerating potential for disruption that is at issue – not the scenario itself.

[…] This post continues the disruption scenario discussion initiated by my earlier Insurance Industry Case Study. I’ve been using the autonomous vehicle (AV) as an example of a disruptive scenario with… […]

LikeLike

We would need 90% less cars than today, so we would only need 25million cars total.

LikeLike

[…] insurance losses – a phenomenon that also plays out in P&C insurance, as the Smart Home and Autonomous Vehicles drive a similar scenario. In each of these cases, premium revenue will decrease in proportion to […]

LikeLike

[…] Autonomous Vehicles: The Automotive Ecosystem […]

LikeLike

[…] and vehicle emissions are reduced. But in the long term, what role does parking serve? The Autonomous Vehicle (another disruptive scenario) ultimately plays a major role in the future smart city, and it could […]

LikeLike

[…] For me, these findings underscore the movement from our current automotive industry to the future Mobility Ecosystem. If we can make the mental model shift from our long standing view of Industry and competition, to […]

LikeLike

[…] autonomous vehicles can be found Here. I visited this scenario in depth as I analyzed the emerging Mobility Ecosystem and the growing case for multi-industry […]

LikeLike

[…] the last three years, I have written about the emerging Mobility Ecosystem and its Disruptive Potential. In 2016, we witnessed the acceleration of this future scenario and […]

LikeLike

[…] is a vehicle that is capable of sensing its environment and moving with little or no human input. Autonomous cars combine a variety of sensors to perceive their surroundings, such as radar, computer vision, Lidar, […]

LikeLike

[…] Autonomous Vehicles: The Automotive Ecosystem […]

LikeLike

[…] Autonomous Vehicles: The Automotive Ecosystem […]

LikeLike

[…] Autonomous Vehicles: The Automotive Ecosystem […]

LikeLike

[…] disruptive scenarios have not emerged on the timeline many expected. So, how close are we really to level five autonomous driving? That quote above provides one man’s opinion. Granted, that opinion comes […]

LikeLike