2014 will see an acceleration and expansion of transformation programs. All the dynamics are in place to create a compelling reason for companies to transform. This 14 part series takes a closer look at transformation and the likely path it takes in the next decade. This is the first piece in the series. Links to the other parts of the series are included at the end of this post.

In my last Post , I focused on three recent thought leadership pieces:

- Middle class job Creation – Geoffrey Moore

- Disruptive Technologies – Mckinsey

- New Machine Age – Andrew McAfee

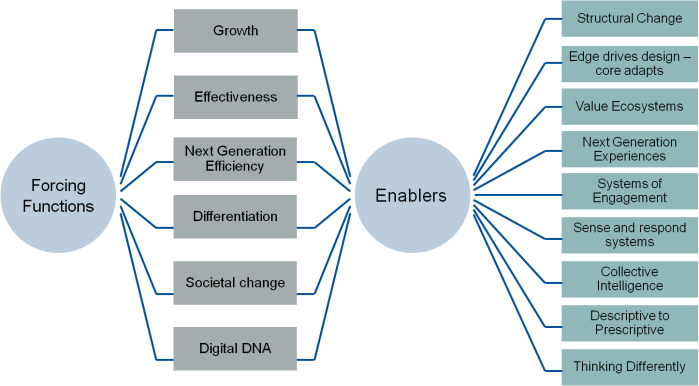

These pieces continue to describe the transformative period that lies ahead. As we look at this and other thought provoking pieces, our job as leaders is to assess the potential impact to our organizations. Readers of my Blog know that I have focused my own assessment on the enterprise of 2020, or what I have been calling the Digital Enterprise. So I have worked to develop a high level road map based on my own perspective and experiences, ongoing executive dialog, and key pieces of market thought leadership. I will use the next several Blog posts to summarize my thinking. The road map is focused in two key areas: The forcing functions that drive the need to transform and the enablers that require investment to get us there. Forcing functions are those things that force the enterprise to invest in a future state. The forcing functions and a vision to address them are critical, as far too many leaders continue to sit on the sidelines with no impetus to invest in this future enterprise.

This diagram summarizes both areas of the road map:

I have focused on a key set of forcing functions that I believe affect companies across every industry, and will begin this series by expanding upon this piece of the road map. The first post will address the growth forcing function.

Companies of all sizes have a new opportunity to create non-traditional revenue streams, as macroeconomic forces are driving a search for new sources of growth. Here are the primary drivers behind the growth forcing function in the next decade:

- Globalization

- Emerging markets

- Three Billion more consumers by 2025

- Commoditization

- Disruption of traditional revenue sources

- The sharing economy

- Idea production versus physical production

- A global shift from a product to service economy

Let’s analyze these drivers by starting with the obvious ones.

We’ve been talking about globalization for a long time, as outsourcing and the rapid advancement of technology amplify its impact. These same technology advancements create new growth opportunities in emerging markets, driving a focus on the innovation needed to capture a share of the three Billion new consumers entering the digital economy by 2025.

Rapid commoditization drives the need for differentiation, and specialization trumps all other tactics as a way to differentiate, create value and enable growth. The core versus context discussion plays heavily here, as more companies seek to divest those aspects of their business that do not contribute to the core.

New market entrants and alternative products and services continue to disrupt traditional sources of revenue and companies across every industry are seeking new, perhaps non-traditional revenue sources. A good example of this is found in the Telco industry, as over-the-top companies continue to disrupt traditional revenue streams. It is clear in this Telco example that the lines between industries are blurring (and may indeed collapse) and value ecosystems are emerging. This increasingly creates future growth opportunities outside a company’s traditional business. Therefore value creation that enables growth will increasingly involve an ecosystem of stakeholders. These value ecosystems require the seamless connections of multiple independent enterprises in order to create value. Examples of value ecosystems: Apple, Connected Car, Mobile Commerce, energy efficiency, etc. This phenomenon has massive implications, and represents a key piece of the broader digital enterprise road map – a massive forcing function.

Now for the not so obvious ones: First, the sharing economy represents a potential new source of revenue and growth. Companies across industries have an opportunity to monetize underutilized assets. But a sharing-barter economy is also redefining the buyer-seller relationship, resulting in potential revenue loss as customers share products and services with each other. Another revenue consequence of this emerging economy is the reduction in Government tax revenues, as people barter rather than buy. The growth agenda must address the implications of the sharing economy – sometimes called the Collaborative Economy.

As the new machine age enables the automation of knowledge, idea production (versus physical production) becomes the next revolution. We talk a lot about innovation as a source of growth, but innovation without an enabling enterprise structure cannot drive growth. For growth to result from innovation and idea production, much transformative work to the very structure of our companies lies ahead.

The last driver is the steady move from a product-oriented economy to a service economy. As this shift accelerates, the impact to traditional sources of revenue expands and our organizational constructs limit our ability to enable or sustain growth. Dave Gray of the Dachis Group does a great job of describing this phenomenon in this piece titled Everything is a Service.

So the growth agenda is a critical forcing function that will drive investment in the future state. While not an exhaustive list, here are some of the key tactics that companies will deploy between now and 2020 to address this forcing function:

- Business model Innovation

- Specialize to differentiate and earn a premium over commoditized competition

- Innovate to capture market share in emerging markets

- Step outside of traditional revenue and industry boundaries

- Create revenue via value ecosystems of specialized independent enterprises

- Enable systems of engagement to effectively manage these value ecosystems

- Monetize underutilized assets in the sharing economy

- Neutralize innovations initiated elsewhere

- Shift the product-service revenue mix

The motivation behind the forcing function piece of the road map is to identify the drivers of change and make them visible. Once identified, leaders can assess the implications of these drivers, and then develop a plan to address them. Subsequent posts will look at each of the forcing functions and enablers identified above. This is a perspective on the future, realizing that no one has a crystal ball. My premise continues to be that chances of success in 2020 are enhanced considerably if companies proactively embark on this transformative journey.

For a review of this entire transformation series, here are the links to each of the prior posts:

Forcing Functions:

Enablers:

[…] In my last Post , I focused on three recent thought leadership pieces: Middle class job Creation – Geoffrey Moore Disruptive Technologies – Mckinsey New Machine Age – Andrew McAfee These pieces con… […]

LikeLike

[…] complexity of value ecosystems – as described in Part One of this series, these value ecosystems will drive the growth agenda. As multiple stakeholders […]

LikeLike

[…] Part 1: Growth […]

LikeLike

[…] Part 1: Growth […]

LikeLike

[…] Part 1: Growth […]

LikeLike

[…] Part 1: Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] Growth […]

LikeLike

[…] the majority of analytics efforts are focused on the first digital enterprise forcing function – Growth and Innovation. Seventy-five percent of Leaders, and 70 percent of all other respondents, attributed the value of […]

LikeLike

[…] 2014 will see an acceleration and expansion of transformation programs. All the dynamics are in place to create a compelling reason for companies to transform. […]

LikeLike